The Roys Report is a blog masquerading as a charity. And the beneficiary of this “charity” is Julie Roys.

Near the beginning of 2019, Julie Roys changed her Julie Roys website to add a menu link directing readers to a “Donate” page where they could send tax-deductible “gifts” to “be equipped to discern the truth” and “help Julie continue her important work.” The page added, “Donations are tax-deductible through a partnership with Judson University.”

In mid-2020, Roys relabeled her blog The Roys Report (the name of her podcast), changing her slogan from “Engaging issues, Seeking truth” to “Reporting the truth, restoring the church,” and in early 2021 began listing a governing advisory board consisting of five people (now four) including Roys herself, and changed the description of “partnership” with Judson to a “special” partnership.

What is this “special partnership,” you might ask? Judson University – a nonprofit liberal arts school – has had 501(c)(3) federal charity non-profit status since 1965. This status allows the profits of the school to not be subject to federal taxes (profits are not distributed to shareholders/owners) and also allows donors to the school to not pay federal taxes on their donations. Not all payments to the school are tax-deductible as donations, of course. Tuition, for example, is not deductible as a donation to the school because it is paid for the benefit of a specific person rather than the school as a whole (this is essential to understanding Roys’ scheme).

While Roys’ website now looks like a charity, in reality, she is using Judson University as a “mere conduit” to launder financial support for her activist journalism through a (for now) actual charity so supporters of her attack pieces can write her salary off of their taxes. This is an illegal application of fiscal sponsorship according to IRS guidance and exposes her “donors” to tax-related prosecution. Likewise, whoever approved this deal at Judson has exposed the school to the possibility of losing its tax-exempt status.

Like Roys’ recent attempt to smear John MacArthur, this malfeasance takes some explaining to untangle.

Fiscal Sponsorship

The school has acted as a fiscal sponsor for the Roys Report for over three years. When legal, this type of arrangement allows a non-profit charity to “lend” its non-profit status to a legally distinct but missionally-aligned project that the charity assumes financial responsibility for. It is common for an organization to be sponsored while going through the process of obtaining its own 501(c)(3) status by the IRS, and Roys’ website claims that Judson is sponsoring her “while The Roys Report is obtaining (federal) non-profit status.” She has been claiming this for over three years.

She offers books and mugs to those who contribute, writing, “Your tax-deductible gift helps our journalists report the truth and hold Christian leaders and organizations accountable” before covering her IRS bases by noting that the book is valued at $14.99 and the mug is valued at $20 (charitable donors must not expect non-specific benefits in return for donating). She showcases a three-person board (four including Roys herself) which includes kooky charismatic lady pastor Wendy Seidman from Thrive Vineyard Church in suburban Chicago, registered Democrat nursing professor Carol Ferrans, and “also a person of color” Steve Joe (Roys’ description, not mine). Roys avoids describing Seidman as a pastor (which would seem relevant to a Christian ministry) before carefully noting that the board is an advisory board, not a governing board (as required by an actual non-profit charity). Note: Anglican priest Eirik Olsen was listed on the board until late 2021, and was described as providing “spiritual care and direction for The Roys Report.”

Yet given all of the care Roys has taken to give the impression that her scandal blog is actually a charitable enterprise, fiscal sponsorship must meet certain requirements for it to be considered legally valid.

Proper Fiscal Sponsorship According to the IRS

Donations made to the sponsoring charity must be entirely in the control of the sponsor, and donations must not be earmarked specifically for the benefit of an individual (this is what disqualifies tuition from being considered a deductible donation). As noted by Ruth Rivera Huetter and Bill Brockner in the IRS document E. CONDUIT ORGANIZATIONS – CHARITABLE DEDUCTIBILITY AND EXEMPTION ISSUES:

A contribution is not considered made “to” a charity if the facts and circumstances show that the charity is merely a conduit to a particular person. If contributions to a fund are earmarked by the donor for a particular individual, they are treated as gifts “to” the designated individual rather than “to” the charitable organization.

…for purposes of determining that a contribution is made to or for the use of an organization described in IRC 170 rather than to a particular individual who ultimately benefits from the contribution, the organization must have full control of the use of the donated funds and the contributor’s intent in making the payment must have been to benefit the charitable organization itself and not the individual recipient.

Not only do the facts and circumstances show that contributions made on Roys’ website are earmarked for a particular individual (Roys) and not the charity (Judson), but the contributor (donors to Roy’s site) is clearly not intending to make the payment to benefit the charitable organization (Judson), but the individual recipient (Roys). In other words, I can no more write off money I send to Judson for the benefit of Roys than I can money I send to Judson to pay my kid’s tuition. Note: tuition payments to any qualified school can reduce taxable income under the right circumstances, but are not considered “donations” to a non-profit school. Also, I wouldn’t send my kids to be indoctrinated by Judson’s wokeness.

Yet Roys’ website makes it clear that donations are made to directly benefit Roys, with no mention that donations are actually required to be fully controlled by Judson, and distributed to Roys at the school’s discretion:

Where’s the Money Going?

Roys was soliciting tax-exempt donations in early 2019, yet Illinois Secretary of State records indicate that the Roys Report not-for-profit did not register as a non-profit entity in the state of Illinois until June of 2021 (after the dates of the two published “financial statements” on her website):

Without a legally-distinct entity, these generalized financial statements are simply records of money gifted to Roys.

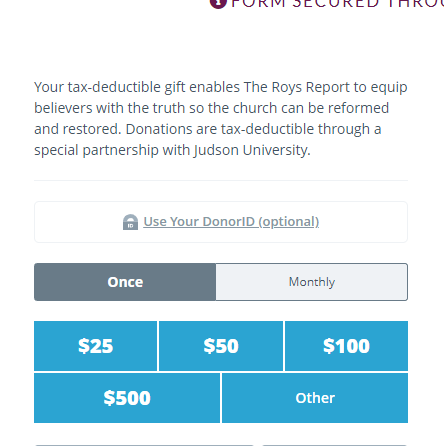

Worse yet, Roys’ most recent statement reveals that 55% of these “donations” (from Judson, corporate sponsors, and individual donors) went straight into the pockets of Roys, her assistant, and her writers:

Somehow, she managed to spend nearly five thousand dollars on books last year (or roughly 200 books at a price of $24/book), and a whopping $7300 on her WordPress (free) website with Elementor Pro ($49/year) and the Astra template ($499 lifetime). For reference, I pay roughly $150/year for unlimited WordPress hosting. Once set up (which is pretty darn easy), the site itself costs virtually nothing to operate, and Roys’ site has been online for years.

Combining these website “service and design” fees with the over $1400 per month in office/software/insurance (why are these on one expense line?), Julie is paying the insane amount of $2018 per month to run a blog before she gives one dime to any freelance writers (who often are publishing articles they’ve published elsewhere).

To be fair, Julie Roys describes herself as a “boomer” when it comes to technology, but considering she is stewarding money that people think they’re donating to a Christian charity these numbers are deeply troubling.

Three Years?

Why is it taking so long for Julie Roys to secure federal 501(c)(3) charitable status? Is it because the IRS is unwilling to accept that a doctrine-free blog that Julie turned into her job after she was fired from Moody is suddenly a federally-recognized charity simply because she would like it to be? Roys could have turned her for-profit blog into an actual non-profit entity years ago, but it was and is clearly a non-charitable enterprise. Yet the goal was to increase the earnings of her scandal blog by offering Judson’s tax-exempt status to her financial supporters, and this requires her operation to be seen as a charity.

According to the non-profit advisory website NGOsource.org, U.S. Treasury regulations define charitability as (emphasis mine):

Relief of the poor and distressed or of the underprivileged; advancement of religion; advancement of education or science; erection or maintenance of public buildings, monuments, or works; lessening of the burdens of government; and promotion of social welfare by organizations designed to accomplish any of the above purposes, or (i) to lessen neighborhood tensions; (ii) to eliminate prejudice and discrimination; (iii) to defend human and civil rights secured by law; or (iv) to combat community deterioration and juvenile delinquency.

This definition doesn’t allow any enterprise to be considered a charity just because it “educates” or is overtly religious. There are many charitable non-profit Christian publications (Christianity Today, for example), but sole proprietorships (which describes Roys’ blog even though she finally registered it as a non-profit corporation in Illinois in June 2021) where the earnings go almost entirely to a single person (after operating expenses) are clearly for the benefit of the person, not a charitable cause. In this case, the target of the “charity” is Julie Roys herself.

A personal blog turned “Christian media outlet” by a self-described “investigative journalist” is not a charity, no matter how much Christian terminology is added to the website. The primary beneficiary of the Roys Report is not the “the community” or “the church” – it is Julie Roys. No reputable Christian charity or ministry engages in tearing down without following with building up. Yet as of this writing, Roys belongs to no church, professes no clear doctrinal standards (in fact she actively obscures what she believes), and spends the money given to her “charity” to scour the internet for dirt on any large ministry she can “expose.” Judson is (in addition to giving Roys money unsuspiciously donated to the school) likely funneling the money given to them on Roys’ website directly to Roys, and this “mere conduit” relationship is expressly prohibited by the IRS and the Treasury Department.

10 responses to “Julie Roys’ Fake Charity is Abusing Tax Laws, Subjecting Her Supporters to IRS Prosecution”

She is helping to restore the church at Laodicea. Leave her alone.

Baloney! The truth is John MacArthur shamed and excommunicated a mother for refusing to take back husband child abuser. Jailed for 20 years to life for these heinous crimes against his own family. And this this Spiritless rag continues to publishes baseless junk like this to obfuscate the fact.

Wow. Lots of hate and evil there. This be Johnny using an assumed name. Get some help, man.

[…] detailing the famous coverup and complicity in child abuse by the church. (see Here, Here and Here) for more information. Taking place at a members meeting following the last service, MacArthur is […]

Your are losing. She may be woke but this baloney is another pathetic attempt to cover up the truth about your god.

You’re nuts!

There’s something inherently dishonest about this framework as anything other than tax avoidance by calling it ministry. As someone who takes others to task for self-enrichment, this is utter hypocrisy.

This is too rich and highly expected. Not too mention very timely. John MacArthur gets exposed (again) and like fleas to dung his supporters come to defend him. With that said, this lady made it too easy. Any hint of impropriety was going to be scrutinized thanks to the very nicely written piece made on her site about MacArthur. Naturally, opinions will be swaded by political stances instead of facts.

Classic case of both having questionable behavior. Yet once again the attention is quite one sided. Go figure.

[…] hosting a “faux #discernment [conference] = Slanderers For Jesus.” MacDonald linked to a Protestia.com article about a “fake charity,” regarding a request for donations through a partnership with […]

[…] the parody-level wokeness of her “ministry” partner Judson University, including discussing what the IRS might have to say about their passthrough non-profit […]